Featured

Table of Contents

- – The Facts About The Advantages and Cons of Deb...

- – Not known Facts About Creating Your Route to S...

- – Some Known Questions About The Benefits to Co...

- – The 10-Minute Rule for What's Coming for Bank...

- – How Post-10 Tips to Boost Your Savings and I...

- – The 7-Second Trick For Steps for Reach a Cou...

Applying for credit rating card financial obligation mercy is not as basic as requesting your balance be removed. Lenders do not readily supply debt mercy, so understanding exactly how to provide your situation effectively can enhance your chances.

I wish to review any type of choices readily available for minimizing or resolving my debt." Financial debt mercy is not an automatic choice; oftentimes, you have to work out with your lenders to have a section of your balance decreased. Bank card business are typically open to negotiations or partial forgiveness if they think it is their finest chance to recuperate some of the cash owed.

The Facts About The Advantages and Cons of Debt Forgiveness Uncovered

If they provide full mercy, obtain the agreement in creating before you accept. You may require to send an official created request discussing your challenge and just how much forgiveness you require and supply paperwork (see following section). To bargain properly, try to comprehend the financial institutions placement and usage that to provide a strong instance as to why they ought to collaborate with you.

Right here are the most common blunders to prevent at the same time: Financial institutions will not just take your word for it. They need evidence of monetary hardship. Constantly ensure you obtain confirmation of any kind of forgiveness, settlement, or challenge strategy in creating. Lenders may supply much less relief than you need. Work out for the very best possible terms.

Financial debt mercy includes lawful considerations that debtors must be mindful of before continuing. The adhering to federal laws assist safeguard customers seeking financial debt mercy: Restricts harassment and abusive financial obligation collection techniques.

Not known Facts About Creating Your Route to Stability

Needs creditors to. Restricts financial debt negotiation business from billing ahead of time charges. Comprehending these securities helps prevent scams and unjust financial institution methods.

Making a payment or even acknowledging the financial debt can reactivate this clock. Also if a creditor "charges off" or creates off a financial debt, it does not suggest the financial obligation is forgiven.

Some Known Questions About The Benefits to Consider of 10 Tips to Boost Your Savings and Improve Financial Health: APFSC.

Prior to consenting to any type of layaway plan, it's an excellent concept to examine the law of constraints in your state. Lawful effects of having financial debt forgivenWhile financial obligation mercy can relieve monetary burden, it comes with possible legal consequences: The IRS treats forgiven financial debt over $600 as gross income. Consumers receive a 1099-C kind and needs to report the quantity when declaring tax obligations.

Below are a few of the exceptions and exemptions: If you were financially troubled (indicating your complete debts were higher than your complete assets) at the time of mercy, you may leave out some or all of the canceled debt from your gross income. You will require to submit Form 982 and connect it to your tax return.

While not connected to charge card, some student financing mercy programs allow financial obligations to be terminated without tax consequences. If the forgiven financial obligation was related to a qualified farm or organization procedure, there might be tax obligation exclusions. If you do not get debt forgiveness, there are alternate financial debt alleviation techniques that may benefit your scenario.

The 10-Minute Rule for What's Coming for Bankruptcy Counseling and Debtor Options

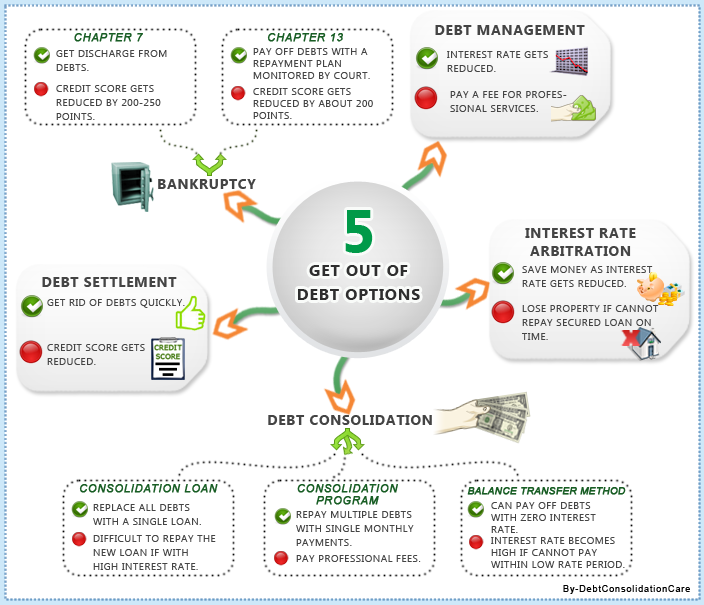

You request a brand-new car loan big sufficient to repay all your existing charge card equilibriums. If accepted, you use the new funding to settle your credit cards, leaving you with simply one regular monthly settlement on the consolidation finance. This streamlines financial debt management and can conserve you money on interest.

Most importantly, the firm works out with your creditors to decrease your rate of interest prices, substantially decreasing your overall financial debt problem. They are a fantastic debt remedy for those with poor credit scores.

Let's encounter it, after numerous years of higher rates, cash doesn't reach it made use of to. Regarding 67% of Americans claim they're living income to income, according to a 2025 PNC Financial institution research, that makes it difficult to pay for financial obligation. That's specifically real if you're carrying a large financial debt equilibrium.

How Post-10 Tips to Boost Your Savings and Improve Financial Health: APFSC Help and Aftercare Services can Save You Time, Stress, and Money.

Combination lendings, financial obligation monitoring strategies and payment techniques are some methods you can use to lower your financial obligation. If you're experiencing a significant financial difficulty and you've tired various other choices, you might take a look at debt mercy. Debt mercy is when a lender forgives all or several of your impressive equilibrium on a financing or various other credit rating account to help ease your financial obligation.

Financial debt forgiveness is when a loan provider consents to eliminate some or every one of your account equilibrium. It's a strategy some individuals use to minimize financial debts such as bank card, personal finances and trainee car loans. Secured financial obligations like home and vehicle loan usually don't qualify, considering that the lending institution can recuperate losses by seizing the security through repossession or foreclosure.

The most widely known choice is Public Service Car Loan Forgiveness (PSLF), which wipes out continuing to be federal financing balances after you work complete time for a qualified employer and make payments for 10 years.

The 7-Second Trick For Steps for Reach a Counselor Now

That suggests any kind of not-for-profit health center you owe may be able to offer you with debt alleviation. Majority of all united state medical facilities provide some kind of clinical financial debt relief, according to person services support team Dollar For, not just not-for-profit ones. These programs, usually called charity treatment, lower and even eliminate clinical expenses for competent people.

Table of Contents

- – The Facts About The Advantages and Cons of Deb...

- – Not known Facts About Creating Your Route to S...

- – Some Known Questions About The Benefits to Co...

- – The 10-Minute Rule for What's Coming for Bank...

- – How Post-10 Tips to Boost Your Savings and I...

- – The 7-Second Trick For Steps for Reach a Cou...

Latest Posts

The smart Trick of Inflation That Affect How More Americans Need Are Seeking How APFSC Helps Veterans Manage Debt That Nobody is Discussing

The Best Strategy To Use For Post-Credit Counseling Services : APFSC Help for Debt Management Help and Check-In Programs

The Only Guide for How Much to Pay for Professional Counseling Help

More

Latest Posts

The Best Strategy To Use For Post-Credit Counseling Services : APFSC Help for Debt Management Help and Check-In Programs

The Only Guide for How Much to Pay for Professional Counseling Help